The Bankers Investment Trust plc (LSE: BNKR) is one of the oldest and most respected investment trusts listed on the London Stock Exchange. Established in 1888, it focuses on providing long-term capital growth and consistent income for its investors. Managed by Janus Henderson Investors, the trust’s diversified portfolio spans global equities, making it a go-to choice for both income-seeking and growth-focused investors.

This article offers an in-depth exploration of the Bankers Investment Trust share price, its influencing factors, and answers to common questions investors and financial enthusiasts often search on Google and YouTube.

What Is the Bankers Investment Trust?

The Bankers Investment Trust plc is a UK-based investment trust with a mandate to deliver reliable capital growth and regular dividend income. It achieves this by maintaining a diversified global equity portfolio spread across various industries and geographies. Key goals include:

Capital Growth: Through strategic equity investments in strong-performing companies worldwide.

Steady Income: Ensuring consistent and growing dividend payments to shareholders.

This dual objective appeals to investors looking for both growth and stability in their portfolios.

Understanding the Bankers Investment Trust Share Price

The share price of an investment trust like Bankers is determined by several factors, including its net asset value (NAV), market demand, and broader economic conditions. Unlike open-ended funds, investment trusts have a fixed number of shares, causing their share price to fluctuate based on supply and demand in the stock market.

Latest Share Price Performance

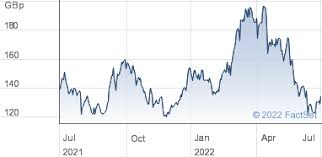

As of December 2024, the Bankers Investment Trust’s share price trades at 115.00 GBX. It reflects market sentiment, portfolio performance, and the trust’s ability to manage investments effectively. Over the last year, the share price fluctuated between 100.00 GBX and 118.40 GBX, showcasing the typical volatility of equities.

Factors Affecting the Bankers Investment Trust Share Price

Several factors influence the Bankers Investment Trust’s share price:

Portfolio Performance

The trust’s diversified global portfolio heavily impacts its share price. Positive returns on investments in sectors such as technology, healthcare, and consumer goods often drive upward momentum.

Net Asset Value (NAV)

The NAV per share represents the underlying value of the trust’s assets divided by the total number of shares. Investors closely monitor the discount or premium of the share price relative to its NAV.

As of December 2024, the NAV stood at 130.54 GBX, indicating the share price traded at a 12.67% discount to its NAV.

Dividend Yield

Bankers Investment Trust has a strong reputation for paying regular dividends. Its current dividend yield of 2.23% appeals to income-focused investors, contributing to demand for its shares.

Market Sentiment

Broader economic and geopolitical events can significantly influence the share price. Market optimism often leads to higher valuations, while uncertainties may cause declines.

Share Buybacks

Recently, Bankers Investment Trust announced a share buyback program, a move aimed at reducing the share count and narrowing the discount to NAV.

Dividend Policy and Income Growth

One of the trust’s standout features is its robust dividend history. The trust has increased dividends every year for decades, making it a member of the “Dividend Heroes” club, which consists of trusts with over 50 years of consecutive dividend growth.

For income investors, this consistent growth offers reliability, even in fluctuating market conditions. The 2024 dividend payments reflect the trust’s ability to maintain its income mandate.

Global Diversification Strategy

Bankers Investment Trust stands out for its global approach to investing. Its portfolio includes companies from developed and emerging markets, providing broad exposure to various growth opportunities.

Key Sectors

Technology: Companies like Microsoft and Apple feature prominently in its holdings.

Healthcare: Investments in pharmaceutical giants and biotech innovators.

Consumer Goods: Brands with strong global presence and stable cash flows.

Comparison with Peer Investment Trusts

The trust competes with other established players in the investment trust space, such as:

Scottish Mortgage Investment Trust (focus on innovation and growth sectors).

F&C Investment Trust (another long-standing trust with a global portfolio).

Investors often compare these trusts based on performance, dividend yield, and NAV discount to determine the best fit for their portfolios.

FAQs

What is the current share price of the Bankers Investment Trust?

As of December 31, 2024, the share price of the Bankers Investment Trust was 115.00 pence.

Share prices fluctuate daily based on market conditions, so it’s advisable to check real-time quotes through financial news platforms or brokerage services for the most current information.

How has the share price performed over the past year?

Over the past 52 weeks, the share price has ranged between a low of 100.00 pence and a high of 118.40 pence, indicating moderate volatility. As of December 4, 2024, the share price was 118.40 pence, marking the 52-week high.

What factors influence the share price of the Bankers Investment Trust?

Several factors can impact the share price:

Net Asset Value (NAV): The NAV represents the per-share value of the trust’s assets minus liabilities. As of December 31, 2024, the estimated NAV was 129.83 pence, with the share price trading at an 11.42% discount to NAV.

Market Conditions: Global economic trends and market sentiment can affect the valuation of the trust’s holdings, thereby influencing the share price.

Dividend Policy: The trust has a history of consistent dividend payments, with a current yield of 2.45%, which can attract income-focused investors and impact demand for the shares.

Why does the share price trade at a discount or premium to NAV?

The share price of investment trusts often trades at a discount or premium to NAV based on investor demand and market sentiment. A discount may indicate lower demand or negative sentiment, while a premium suggests higher demand or a positive outlook. As of December 31, 2024, the Bankers Investment Trust was trading at an 11.42% discount to its NAV.

How can I invest in the Bankers Investment Trust?

Investors can purchase shares through various brokerage platforms that offer access to the London Stock Exchange, where the trust is listed under the ticker BNKR. It’s advisable to consult with a financial advisor to ensure this investment aligns with your financial goals and risk tolerance.

In Summary

The Bankers Investment Trust offers investors exposure to a diversified global portfolio with a focus on long-term capital growth and consistent income. Its share price is influenced by various factors, including NAV, market conditions, and dividend policies. As of December 31, 2024, the trust was trading at a notable discount to its NAV, which may present an opportunity for value-seeking investors. However, it’s essential to consider the associated risks and conduct thorough research or consult with a financial advisor before making investment decisions.

To read more, Click here.