The Brooks Macdonald Group (LSE: BRK) is a prominent wealth management firm in the UK, offering tailored investment solutions to high-net-worth individuals, institutions, and charities. Its performance in the financial markets has drawn interest from investors and analysts alike, with the share price acting as a barometer for the company’s health and market sentiment.

This article delves into the latest developments surrounding Brooks Macdonald’s share price, factors influencing its movements, and the broader implications for stakeholders.

About Brooks Macdonald

Founded in 1991, Brooks Macdonald has built a reputation for providing personalized wealth management services. The company specializes in investment management and financial planning, catering to a diverse client base. With over £16 billion in assets under management (AUM) as of 2024, the firm operates from multiple offices across the UK, ensuring a localized yet sophisticated approach to client needs.

Recent Share Price Performance

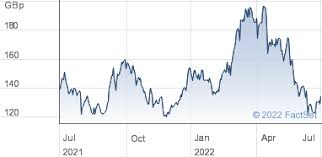

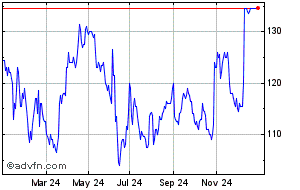

As of late 2024, Brooks Macdonald’s share price has been navigating a challenging but evolving market landscape. The stock, listed on the London Stock Exchange under the ticker BRK, closed at 1,675 GBX on December 31, 2024. This represented an increase from its 52-week low of 1,505 GBX earlier in the month but remains below its peak of 2,140 GBX in May 2024.

The year has been marked by volatility, with the share price reflecting both industry-wide challenges and company-specific developments.

Key Factors Influencing the Share Price

Financial Performance

The company’s financial results play a critical role in shaping investor sentiment. Brooks Macdonald’s half-year report for 2024 highlighted modest revenue growth driven by increased client activity, but profitability remained under pressure due to rising costs and market headwinds. Investors have been closely watching these metrics to gauge the company’s operational efficiency and growth prospects.

Dividend Policy

Brooks Macdonald has maintained a consistent dividend payout, offering a yield of 4.71% as of the latest data. The annual dividend of 78 GBX per share underlines the company’s commitment to shareholder returns, even amid challenging market conditions.

Strategic Shifts

The appointment of Andrea Montague as CEO in September 2024 marked a significant leadership change. Under her guidance, the firm has focused on:

Expanding its high-net-worth client base.

Streamlining operations to reduce costs.

Exploring mergers and acquisitions to boost growth.

These strategic shifts have been pivotal in shaping market expectations and influencing share price trends.

Industry Trends

The wealth management sector has experienced both opportunities and challenges in recent years:

Rising Client Expectations: High-net-worth clients demand more tailored and innovative solutions, driving firms to invest in technology and expertise.

Market Volatility: Fluctuations in equity and bond markets directly impact AUM and revenue streams.

Regulatory Pressures: Increasing compliance requirements add to operational costs, impacting profitability.

Analyst Predictions and Market Sentiment

Analysts have mixed but generally positive expectations for Brooks Macdonald. The average target price of 2,266 GBX suggests significant upside potential from the current levels. However, concerns about rising costs and competitive pressures temper enthusiasm.

Key insights from analysts:

Bullish Perspective: Proponents highlight Brooks Macdonald’s strong market position and the growth of the UK wealth management industry as positive indicators.

Cautious Perspective: Critics point to operational inefficiencies and the need for better cost management.

Investor Considerations

Potential investors should weigh the following:

Growth Potential: The wealth management sector continues to grow, offering opportunities for firms like Brooks Macdonald.

Risk Factors: Market volatility and operational challenges could impact short-term performance.

Long-Term Strategy: The company’s focus on high-net-worth clients and M&A could yield substantial returns over time.

FAQs

What is the analyst consensus on Brooks Macdonald’s share price?

Analysts have set an average target price of 2,266.43 GBX for Brooks Macdonald, suggesting a potential upside of approximately 39.9% from the last closing price of 1,620.00 GBX. This indicates a positive outlook among analysts regarding the company’s future performance.

What factors influence Brooks Macdonald’s share price?

Several factors can impact the share price, including:

Financial Performance: Revenue growth, profitability, and asset under management (AUM) figures play a significant role.

Market Conditions: Economic indicators and market sentiment can affect investor confidence.

Strategic Initiatives: Business decisions, such as mergers and acquisitions or shifts in service offerings, can influence perceptions of future growth.

Regulatory Environment: Changes in financial regulations can impact operational costs and profitability.

Does Brooks Macdonald pay dividends?

Yes, Brooks Macdonald has a history of paying dividends. The current dividend yield is approximately 4.71%, with an annual dividend of 78.00 GBX per share. This reflects the company’s commitment to returning value to shareholders.

How does Brooks Macdonald’s share price compare to its competitors?

Brooks Macdonald operates in the competitive wealth management sector. While its share price has experienced fluctuations, it’s essential to compare metrics such as price-to-earnings ratios, dividend yields, and market capitalization with peers to gain a comprehensive understanding.

What recent developments have affected Brooks Macdonald’s share price?

In September 2024, Brooks Macdonald appointed Andrea Montague as CEO, signaling a strategic shift towards high-net-worth clients and bespoke portfolio services. The firm has also expressed intentions to pursue mergers and acquisitions to drive growth.

In Summary

Brooks Macdonald Group plc represents a compelling investment opportunity in the dynamic wealth management sector. Its share price reflects a blend of challenges and opportunities, with significant upside potential if the company can execute its strategic vision effectively.

The firm’s commitment to client-centric services, coupled with its focus on technology and operational efficiency, positions it for long-term success. However, investors should remain vigilant about market risks and conduct thorough due diligence before investing.

To read more, Click here.