Equals Group plc (LSE: EQLS) is a financial technology company specializing in international payments and foreign exchange services. This article will delve into the factors influencing its share price, historical performance, and potential future trends.

Understanding Equals

Equals offers a range of financial products and services, including:

International Payments: Facilitating cross-border payments for businesses and individuals, enabling them to send and receive money globally.

Foreign Exchange Services: Providing competitive exchange rates and currency conversion services for businesses and individuals.

Travel Money Solutions: Offering prepaid travel cards, currency exchange, and other travel-related financial services.

Technology Platforms: Developing and providing innovative technology platforms for businesses to manage their international payments and foreign exchange needs.

Factors Influencing Equals Share Price

Several key factors can significantly impact Equals’ share price:

Economic Conditions: Global economic conditions, including interest rates, inflation, and currency exchange rates, can significantly impact Equals’ business and financial performance.

Competition: Equals faces competition from other financial institutions, fintech companies, and payment processors, such as banks, money transfer companies, and online payment platforms.

Regulatory Environment: Changes in regulations related to financial services, anti-money laundering, and data privacy can impact Equals’ operations and profitability.

Technological Innovation: The rapid evolution of technology, including advancements in blockchain, artificial intelligence, and mobile payments, can create new opportunities and challenges for Equals.

Customer Demand: Changes in customer demand for international payments and foreign exchange services, driven by factors such as globalization, e-commerce, and travel trends, can significantly impact Equals’ revenue and profitability.

Financial Performance: Equals’ financial performance, including revenue growth, profitability, and cash flow, is a key determinant of its share price. Investors closely monitor these metrics to assess the company’s financial health and future prospects.

Investor Sentiment: Investor sentiment and market conditions can significantly influence Equals’ share price. Factors such as overall market volatility, economic conditions, and investor confidence can impact demand for Equals shares.

Historical Performance

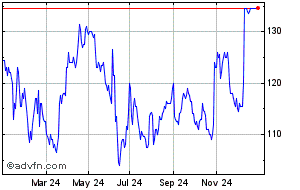

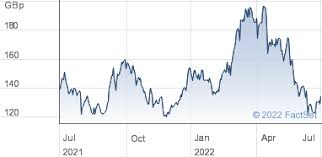

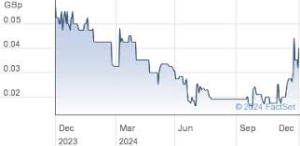

Equals’ share price has exhibited significant volatility over time, reflecting the dynamic nature of the financial technology sector and the company’s own evolving business model.

Early Years: In its early years, Equals experienced rapid growth and a corresponding increase in its share price, driven by the increasing demand for international payments and foreign exchange services.

Recent Trends: In recent years, Equals’ share price has faced challenges, reflecting factors such as increased competition, evolving market dynamics, and the impact of global economic events.

Analyzing Equals’ Share Price

To effectively analyze Equals’ share price, investors can consider the following:

Fundamental Analysis: This involves evaluating Equals’ financial performance, including revenue growth, profitability, and cash flow. It also includes assessing the company’s competitive position, management team, and long-term growth prospects.

Technical Analysis: This involves studying historical price and volume data to identify patterns and trends that may predict future price movements. Technical analysis techniques include chart patterns, moving averages, and other indicators.

News and Events: Staying informed about industry news, company announcements, and other relevant events can provide valuable insights into Equals’ future prospects and potential impact on its share price.

Potential Future Trends

The future of Equals’ share price is inherently uncertain and will depend on a variety of factors. However, some potential future trends include:

Continued Growth of International Payments: The continued growth of global trade and e-commerce is likely to drive demand for international payment and foreign exchange services, creating opportunities for Equals.

Technological Innovation: Equals may leverage technological advancements to improve its services, reduce costs, and enhance the customer experience.

Strategic Acquisitions: Equals may pursue strategic acquisitions to expand its market share, acquire new technologies, or enter new markets.

Focus on Emerging Markets: Equals may focus on expanding its presence in emerging markets, which offer significant growth potential for international payments.

Disclaimer:

This article is for informational purposes only and should not be construed as financial advice. Investing in stocks, including Equals shares, involves significant risks, and investors could lose all or part of their investment.

Key Takeaways:

Equals operates in a dynamic and competitive financial technology sector.

Several factors, including economic conditions, competition, and technological innovation, can significantly impact Equals’ share price.

Equals’ share price has exhibited significant volatility over time.

Investors can analyze Equals’ share price through fundamental and technical analysis.

The future of Equals’ share price will depend on a variety of factors, including industry trends, company performance, and market conditions.

Further Research:

Investors interested in learning more about Equals and its share price can refer to the following resources:

Equals Investor Relations Website: [invalid URL removed]

Financial News Websites: Websites such as Bloomberg, Yahoo Finance, and Google Finance provide real-time quotes, historical data, and news related to Equals.

Brokerage Reports: Research reports from investment banks and brokerage firms can provide in-depth analysis of Equals’ business and its share price.

FAQs

What factors have influenced Equals Group plc’s share price recently?

Several key factors have impacted the company’s share price:

Takeover Bid: In November 2023, a consortium led by TowerBrook Capital Partners, JC Flowers, and Railsr proposed a £283 million cash bid for Equals Group, valuing the company at 135p per share. This offer has been met with mixed reactions from investors, with some major shareholders expressing intentions to vote against it, arguing that it undervalues the company’s strategic assets.

Financial Performance: Equals Group has demonstrated strong financial growth, particularly in its business-to-business (B2B) segment. The company’s shift towards B2B services has resulted in significant revenue and EBITDA increases, enhancing its appeal to potential investors and acquirers.

Extended Negotiations: The takeover process has been unusually prolonged, with the ‘put up or shut up’ (PUSU) deadline extended multiple times to allow the consortium to finalize its acquisition bid. As of November 20, 2024, the UK Panel on Takeovers & Mergers extended the deadline at the request of Equals’ board, indicating ongoing negotiations.

How does Equals Group plc’s share price compare to its competitors?

Equals Group plc operates in the fintech sector, which includes companies like The Hut Group (THG). Recently, THG shareholders voted to spin off its e-commerce platform, valuing it at £90 million. This decision reflects the dynamic nature of the fintech industry and the varying valuations of companies within it.

What is the Price-to-Earnings (P/E) ratio of Equals Group plc?

Equals Group plc has a Price-to-Earnings (P/E) ratio of approximately 32.57, indicating the market’s valuation of the company’s earnings potential.

How has Equals Group plc’s share price been affected by the proposed takeover bid?

The proposed takeover bid has introduced uncertainty into Equals Group plc’s share price. While the offer price of 135p per share is close to the current trading price, some investors view it as undervaluing the company’s strategic assets, leading to mixed reactions in the market.

What is the consensus target price for Equals Group plc shares?

The consensus target price for Equals Group plc shares is around 130p, slightly below the current trading price and the consortium’s offer. This suggests potential upside if the company can execute its strategic initiatives effectively.

In Summary

Equals Group plc operates in a dynamic and rapidly evolving fintech industry with significant growth potential. Its share price reflects both the opportunities and challenges inherent in the sector. The ongoing takeover bid adds a layer of complexity, with potential implications for the company’s future direction and valuation. Investors should conduct thorough due diligence, considering the company’s strategic direction, financial health, and industry trends, before making investment decisions.

To read more, Click here.