The euro to pound sterling (EUR/GBP) exchange rate represents the value of the euro (EUR) against the British pound (GBP). This rate is a crucial economic indicator, influencing businesses engaged in trade between the Eurozone and the United Kingdom, tourists traveling between these regions, and individuals involved in financial transactions involving these currencies. This article provides a comprehensive overview of the EUR/GBP exchange rate, exploring its historical trends, the factors that influence it, how to track it, and practical tips for navigating its fluctuations.

Understanding the EUR/GBP Exchange Rate

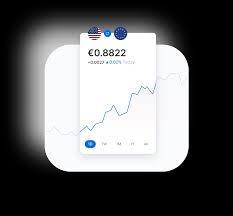

The EUR/GBP exchange rate indicates how many British pounds you can obtain for one euro. For example, an EUR/GBP rate of 0.85 means that one euro can be exchanged for 0.85 British pounds. This rate is constantly changing, reflecting the relative strength and weaknesses of the two economies, as well as global economic and political events. It’s a floating exchange rate, meaning its value is primarily determined by market forces of supply and demand.

Historical Context of EUR/GBP

The EUR/GBP exchange rate has experienced significant fluctuations since the euro’s introduction in 1999. Before the euro, the pound was often compared to individual European currencies like the German Mark or the French Franc. The early years of the euro saw the pound generally stronger, but the global financial crisis of 2008 significantly impacted the rate, weakening the pound considerably. The UK’s decision to leave the European Union (Brexit) in 2016 triggered further volatility, with the pound depreciating significantly against the euro following the referendum. The years since Brexit have been marked by continued uncertainty and negotiations, leading to ongoing fluctuations in the EUR/GBP exchange rate. Understanding these historical trends provides valuable context for interpreting current market movements.

Factors Influencing the EUR/GBP Exchange Rate

Several key factors drive the fluctuations of the EUR/GBP exchange rate:

Economic Growth: The relative economic performance of the Eurozone and the UK is a major driver. Stronger economic growth in one region often leads to a stronger currency. Indicators like GDP growth, employment figures, and manufacturing data are closely watched by traders.

Interest Rates: Interest rate differentials between the European Central Bank (the Eurozone’s central bank) and the Bank of England (the UK’s central bank) can significantly impact the exchange rate. Higher interest rates in one region can attract foreign investment, increasing demand for that currency.

Inflation: Inflation rates in both the Eurozone and the UK play a crucial role. Higher inflation can erode a currency’s value, making it less attractive to investors. Central banks closely monitor inflation and adjust monetary policy accordingly.

Political Stability: Political events and uncertainty can have a major impact on currency markets. Political instability, such as elections, referendums, or geopolitical tensions, can lead to increased volatility and weaken a currency. Brexit serves as a prime example of how political events can significantly impact the EUR/GBP exchange rate.

Market Sentiment: Investor confidence and market sentiment can also influence currency movements. Positive news and strong investor sentiment can boost a currency, while negative news or uncertainty can weaken it.

Trade Balances: The balance of trade between the Eurozone and the UK can also affect the exchange rate. A trade surplus (exports exceeding imports) can strengthen a currency, while a trade deficit can weaken it.

Speculation: Currency traders and speculators play a significant role in the foreign exchange market. Their buying and selling activities can influence exchange rate movements, particularly in the short term.

Global Events: Global economic events, such as recessions, financial crises, or pandemics, can have a broad impact on currency markets, including the EUR/GBP exchange rate.

Tracking the EUR/GBP Exchange Rate

Numerous resources are available for tracking the EUR/GBP exchange rate:

Financial News Websites: Reputable financial news websites, such as Bloomberg, Reuters, and the Financial Times, provide real-time exchange rate information, charts, and analysis.

Currency Converter Websites: Websites like XE.com and Oanda.com offer real-time currency conversion tools and historical exchange rate data.

Central Bank Websites: The European Central Bank and the Bank of England websites provide official exchange rate information and policy statements.

Brokerage Platforms: Online brokerage platforms offer real-time exchange rate data and charting tools for traders.

Mobile Apps: Numerous mobile apps are available for tracking currency exchange rates on the go.

Practical Tips for Navigating EUR/GBP Fluctuations

Stay Informed: Keep up-to-date on economic and political developments in both the Eurozone and the UK. Understanding the factors that influence the exchange rate can help you anticipate potential movements.

Compare Exchange Rates: When exchanging currency, compare rates from different providers, including banks, currency exchange bureaus, and online platforms. Look for the best exchange rate and be aware of any fees or commissions.

Consider Timing: If you have a large currency exchange to make, consider the timing. While it’s impossible to predict market movements perfectly, understanding trends and potential risks can help you make informed decisions.

Use Limit Orders: For larger transactions, consider using limit orders to buy or sell currency at a specific price. This can help you take advantage of favorable exchange rate movements.

Hedge Currency Risk: Businesses involved in international trade can use hedging strategies to mitigate currency risk. This involves using financial instruments, such as futures or options, to lock in exchange rates for future transactions.

Use Currency Alerts: Set up currency alerts to notify you when the EUR/GBP exchange rate reaches a specific level. This can help you capitalize on favorable exchange rate movements.

Consult a Financial Advisor: If you’re unsure about how to manage currency risk or make informed decisions about currency exchange, consult a financial advisor.

The Impact of Brexit on EUR/GBP

Brexit has had a significant and ongoing impact on the EUR/GBP exchange rate. The uncertainty surrounding the UK’s departure from the EU led to a sharp depreciation of the pound following the 2016 referendum. Since then, the pound has remained volatile, reacting to developments in the Brexit negotiations and the subsequent trade agreements. The long-term impact of Brexit on the EUR/GBP exchange rate is still unfolding and will depend on the future relationship between the UK and the EU.

The Future of EUR/GBP

Predicting the future of the EUR/GBP exchange rate is challenging due to the numerous factors that can influence it. The ongoing economic and political relationship between the UK and the EU, as well as global economic trends, will continue to play a crucial role. The evolution of monetary policy in both the Eurozone and the UK, along with inflation and growth prospects, will also be key determinants. Staying informed about these factors and utilizing the available resources will be essential for navigating the future of the EUR/GBP exchange rate.

FAQs

What does the EUR to GBP exchange rate mean?

The EUR to GBP exchange rate represents the value of the euro (EUR) in relation to the British pound sterling (GBP). It tells you how many British pounds you can get for one euro. For instance, an EUR/GBP rate of 0.85 means that one euro can be exchanged for 0.85 British pounds. This rate constantly fluctuates, reflecting the relative strength of the two currencies.

What factors influence the EUR/GBP exchange rate?

Several interconnected factors drive the EUR/GBP exchange rate. Key influences include the relative economic growth of the Eurozone and the UK, interest rates set by the European Central Bank and the Bank of England, inflation rates in both regions, political stability (or instability), market sentiment and investor confidence, trade balances between the Eurozone and the UK, speculation by currency traders, and global economic events such as recessions, financial crises, or pandemics. Brexit also continues to play a role.

How has Brexit affected the EUR/GBP exchange rate?

Brexit has introduced significant volatility and has generally strengthened the euro against the pound. The uncertainty surrounding the UK’s departure from the EU led to a sharp depreciation of the pound after the 2016 referendum, and the rate has remained sensitive to Brexit-related news and developments ever since. The long-term effects of Brexit are still unfolding and depend on the evolving economic and political relationship between the UK and the EU.

Where can I find the current EUR/GBP exchange rate?

You can find the most up-to-date EUR/GBP exchange rate on numerous financial websites like Bloomberg, Reuters, and the Financial Times. Currency converter websites such as XE.com and Oanda.com also provide real-time exchange rate information. Central bank websites, including the European Central Bank and the Bank of England, offer official exchange rate data. Many brokerage platforms and mobile apps also provide real-time currency information.

How can I track the EUR/GBP exchange rate over time?

Most of the aforementioned resources, including financial news websites and currency converter platforms, also offer historical exchange rate data and charting tools. These resources enable you to track the EUR/GBP rate over various timeframes, identify trends, and analyze past fluctuations.

In Summary

The euro to pound sterling exchange rate is a dynamic and ever-changing variable shaped by a complex interplay of economic, political, and global factors. Understanding these factors is crucial for anyone involved in transactions between the Eurozone and the United Kingdom. Staying informed about economic and political developments, utilizing available resources for tracking exchange rates, and comparing rates from various providers are essential steps in navigating the complexities of the EUR/GBP exchange rate.

The continuing impact of Brexit adds another layer of complexity. While predicting future exchange rate movements is challenging, a thorough understanding of the factors that drive the rate can empower individuals and businesses to make informed decisions and manage currency risk effectively. Whether you’re a traveler, a business owner, or simply interested in global finance, keeping abreast of the EUR/GBP exchange rate and its underlying drivers is essential in today’s interconnected world.

To read more, Click here.