Genel Energy plc, a prominent independent oil and gas exploration and production company, has been a significant player in the energy sector. Understanding its stock performance is crucial for investors and stakeholders. This comprehensive analysis delves into the current stock price, historical performance, factors influencing its valuation, and future outlook.

Company Overview

Genel Energy focuses on the exploration, development, and production of oil and gas reserves, primarily in the Kurdistan Region of Iraq. The company’s key assets include the Taq Taq and Tawke oil fields, which have been instrumental in its production capacity. Genel Energy is listed on the London Stock Exchange under the ticker symbol GENL.

Current Stock Price

As of December 31, 2024, Genel Energy’s stock price closed at £66.00, reflecting a 12.63% increase from the 52-week low of £58.60 set on December 19, 2024.

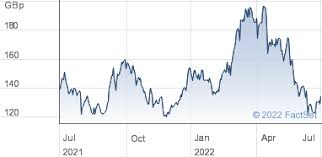

Historical Stock Performance

Over the past year, Genel Energy’s stock has experienced fluctuations, trading between £44.20 and £103.00. These variations are influenced by factors such as global oil prices, geopolitical events, and company-specific developments.

Factors Influencing Stock Price

Several key factors impact Genel Energy’s stock price:

Oil Prices: As an oil producer, Genel Energy’s revenue is closely tied to global oil prices. Fluctuations in oil prices can significantly affect profitability and, consequently, stock performance.

Geopolitical Events: Operating primarily in the Kurdistan Region of Iraq, Genel Energy is susceptible to regional political instability, which can influence production and revenue.

Operational Performance: The company’s ability to maintain and increase production levels, manage costs, and execute successful exploration projects directly impacts its financial health and stock valuation.

Market Sentiment: Investor perception, influenced by news, analyst reports, and broader market trends, can lead to stock price volatility.

Recent Developments

In recent months, Genel Energy has faced challenges, including a ruling by the London Court of International Arbitration in favor of the Kurdistan Regional Government, which may affect the company’s operations.

Investment Considerations

Investors should consider the following when evaluating Genel Energy’s stock:

Risk Assessment: The company’s exposure to geopolitical risks and oil price volatility necessitates a thorough risk evaluation.

Financial Health: Reviewing financial statements, debt levels, and cash flow is essential to assess the company’s stability.

Market Trends: Staying informed about global energy market trends and regional political developments is crucial for making informed investment decisions.

FAQs

What is the current stock price of Genel Energy?

As of January 2025, Genel Energy’s stock price is hovering around £64.90. The price fluctuated recently with a slight recovery from a 52-week low of £58.60, which occurred on December 19, 2024. Stock prices for energy companies like Genel Energy are highly sensitive to market conditions, and they experience changes in real-time based on global commodity prices, geopolitical developments, and market sentiment. Therefore, the stock price is often subject to volatility depending on both broader macroeconomic factors and specific company-related events. To get the most accurate and up-to-date price, investors typically check financial platforms like the London Stock Exchange (LSE), or platforms like FT Markets and Bloomberg.

How has Genel Energy’s stock price performed historically?

Genel Energy’s stock price has demonstrated significant volatility over the past year, ranging from a low of £44.20 to a high of £103.00. This price movement largely mirrors fluctuations in global oil prices and the political dynamics in the Kurdistan region where the company operates. Historically, energy stocks like Genel Energy have been susceptible to changes in oil prices, as they directly affect the company’s revenues from its oil fields in the Kurdistan Region of Iraq. Along with the general oil price trends, investors keep an eye on geopolitical events, market trends, and operational performance when assessing how Genel Energy’s stock price might move.

What are the primary factors affecting Genel Energy’s stock price?

Several key factors influence Genel Energy’s stock price:

Oil Prices: As an oil exploration and production company, the price of crude oil is the most significant determinant of Genel’s revenues. Oil prices directly impact the company’s earnings from its production fields in Kurdistan. If oil prices surge, Genel’s profitability rises, often resulting in a corresponding increase in stock price.

Geopolitical Stability: Genel operates primarily in the Kurdistan Region of Iraq, an area with notable political instability and occasional conflicts. Any geopolitical unrest in the region can lead to disruptions in production, affecting the stock price negatively. For example, tensions between the Kurdistan Regional Government (KRG) and the Iraqi central government or other regional conflicts could impact Genel’s ability to operate smoothly, which would likely hurt investor sentiment.

Operational Performance: Genel’s ability to increase production, manage operational costs, and develop new assets plays a significant role in stock price movements. Investors closely monitor the company’s quarterly earnings reports, its cash flow, and its ability to reduce debt or execute exploration plans effectively. Positive financial results, such as strong production growth, often lead to stock price increases.

Global Market Sentiment: Broader market sentiment also impacts the stock price of Genel Energy. For instance, a shift in investor preference from energy stocks to technology stocks, or changes in interest rates, could lead to fluctuations in stock prices across the energy sector.

What are the recent developments affecting Genel Energy’s stock price?

Genel Energy has been facing both challenges and opportunities in recent months. One of the more notable developments is the ruling in favor of the Kurdistan Regional Government (KRG) by the London Court of International Arbitration. This has impacted investor confidence, as there are concerns over the company’s operations in the region. Furthermore, oil price fluctuations have contributed to fluctuations in stock price performance. Global trends in energy demand and prices, as well as internal factors like Genel’s progress on its production fields, will continue to shape investor perceptions and the stock price in the coming months.

Does Genel Energy offer dividends to shareholders?

At present, Genel Energy does not pay out regular dividends. Instead, the company focuses on reinvesting its profits into the business, particularly for exploration and development projects. This approach is common for companies in the energy sector, especially those in growth or investment phases. However, future dividend payments may be considered depending on the company’s profitability and cash flow situation. Investors should monitor the company’s annual financial statements for updates on any changes in dividend policy.

In Summary

Genel Energy’s stock price, like many energy stocks, is influenced by a complex range of factors including oil prices, geopolitical risk, operational performance, and broader market sentiment. With oil being the primary driver of the company’s revenue, the price of crude oil remains the most influential factor in the stock’s price movement. Geopolitical instability in the Kurdistan Region continues to present a significant risk, but the company’s solid asset base and production fields provide potential growth opportunities for investors. As always, investing in Genel Energy—or any energy company—requires careful analysis of the broader market and individual company dynamics.

In conclusion, potential investors must remain informed about developments in global oil markets, the company’s operational strategies, and regional geopolitical risks. Staying updated on quarterly reports and financial statements will provide insight into how the company is navigating these challenges and opportunities. Therefore, while there is potential for profit, there are also significant risks, and investors should consult with financial advisors and consider these risks before making investment decisions in Genel Energy’s stock.

To read more, Click here.